Mining with Megawatts

The Evolution of Crypto Mining in Wholesale Power Markets

March 6, 2023 | CWP Energy Solutions

If wholesale power markets and cryptocurrencies share one common trait, it is volatility. The rise in popularity of cryptocurrency, particularly Bitcoin, has resulted in a variety of externalities. Outside of contentious discussion around family holidays, one of the biggest impacts has been to energy consumption.

In May 2021, the Chinese Government issued a ban on cryptocurrency and affiliated services, sending miners sprawling across the globe in pursuit of affordable electricity. The United States, with relatively low-cost electricity and a stable geopolitical environment, became an attractive location.

In Bitcoin Mining, new transactions are validated and added to the blockchain via Bitcoin’s “proof-of-work” mechanism. The validation process requires computational power, which is provided by mining machines consuming electricity. The miner who ultimately validates the transaction is compensated with Bitcoin, creating the incentive to mine.

In short, mining is profitable when the cost of mining (largely tied to the cost of electricity) is less than the market value of the awarded cryptocurrency.

Miners first approached the US energy space like many large loads did historically, contracting with utilities under industrial-rate pass throughs or with fixed rate offtake in longer-term deals. This worked well at first, when the value of Bitcoin far exceeded the cost of mining.

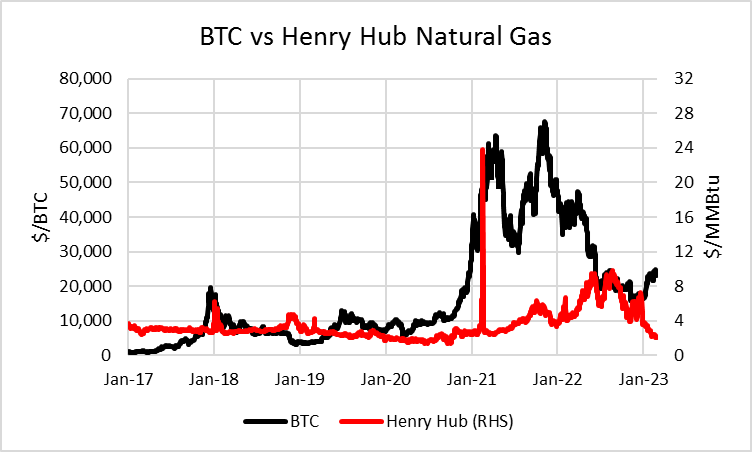

However, headwinds emerged in 2022. An erosion in Bitcoin value coupled with a rapid increase in natural gas prices (and in turn, power prices) squeezed margins and put pressure on balance sheets. Miners who had financed new facilities with large amounts of debt were suddenly in need of cash, as their original power procurement arrangements rendered their operations unprofitable. As a result, the industry was forced to adapt, seeking new and creative ways to manage power costs.

Miners can generally procure electricity in two manners: (1) “front-of-the-meter,” in which the miner consumes electricity straight from the grid and, (2) “behind-the-meter” where the miner consumes electricity directly from a generator, before it is delivered to the grid. The “traditional” path is classified as “front-of-the-meter,” where the mine is paying a fixed rate or pass-through on energy costs from the utility.

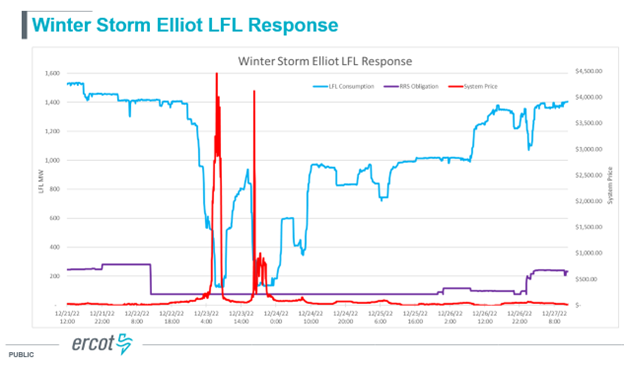

As margins thinned, miners in front of the meter began looking for alternative revenue streams. In many cases this materialized in the registration of the mine as a load resource, where it had the option to procure wholesale power on an hourly basis in Day-Ahead or Real-Time markets, as well as offer ancillary services. ERCOT became particularly attractive due to significant congestion, lower barriers to entry, and the ability to pursue various revenue streams. Crypto mining facilities, referred to as Large Flexible Loads (LFL) in ERCOT, have now reached significant capacity and continue to grow. As demonstrated during Winter Storm Elliot, not only were LFLs capable of responding to price signals, but the ability to reduce consumption rapidly aided in supporting system reliability.

While some miners focused on wholesale power market revenues, others turned to ailing generators – often plagued by heavy congestion and frequent curtailment – and went “behind-the-meter,” purchasing fixed volumes at fixed prices. The miner’s willingness to pay was frequently above the wholesale market capture rate, making it an attractive option for the generator willing to sell them power behind the meter.

While these new and creative strategies created new revenue streams, they also introduced new risks. Now instead of having a binary decision in deciding when to mine or not, asset managers managing mines (or portfolios consisting of mines) now have a complex optimization problem at hand – how do I get the most revenue out of each MW consumed?

At CWP Energy Solutions, we are pioneering the newfound intersection of crypto mining and power markets, leveraging our best-in-class data analytics and proven market expertise to provide incremental value to controllable loads and generators alike. The same infrastructure that bolsters the success of our parent trading fund, CWP Energy, is the backbone of our distinguished asset optimization services. Whether it is an intermittent generating resource, battery storage resource, flexible load, or portfolio containing all of the above, our Active Asset Management Service is tailored to meet the needs of the client.

We’ll be at the Solar & Wind Finance and Investment Summit in Phoenix, AZ next week – if you have not already, reach out to our team and set up some time to chat!